Thinking about buying your dream home but unsure if you qualify for a home loan? Understanding the home loan eligibility criteria is the key to making your dream a reality.

Knowing what lenders look for can save you time, stress, and even money. You’ll discover exactly what factors affect your eligibility and how you can improve your chances of getting approved. Keep reading to unlock the secrets that can turn your homeownership goals into a clear, achievable plan.

Income Requirements

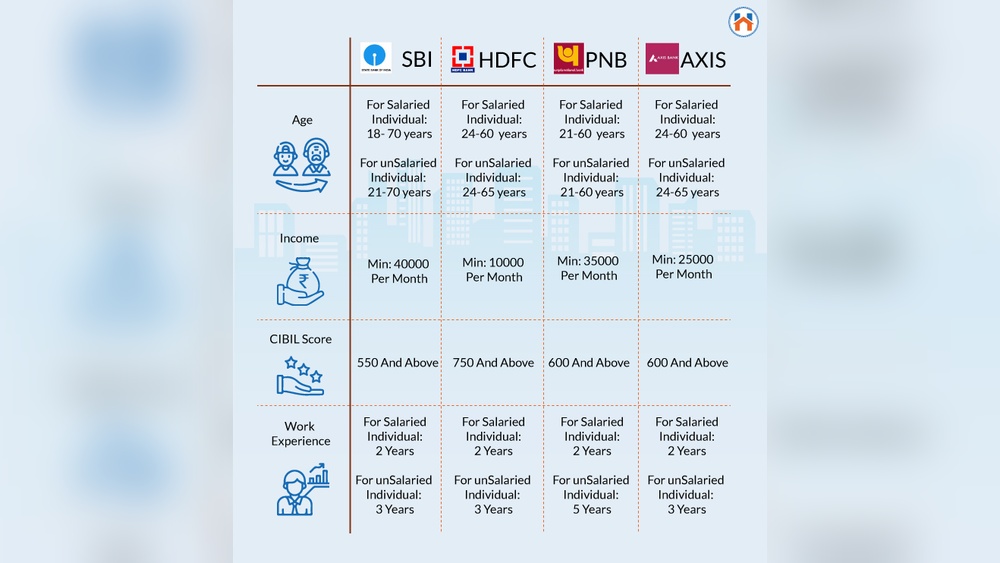

Most banks need a minimum income to approve a home loan. This amount varies by lender and location. It helps banks check if borrowers can repay the loan comfortably.

Stable income is key for loan approval. Salaried employees usually provide salary slips and bank statements. This proves steady earnings over time.

Self-employed people must show proof of consistent income. This includes tax returns, business profit statements, and bank records. Lenders want to see steady profits for at least two years.

| Income Type | Requirements |

|---|---|

| Minimum Income | Varies by bank and loan amount |

| Stable Income | Salary slips, bank statements for 6-12 months |

| Self-Employed Income | Tax returns, profit & loss statements for 2 years |

Credit Score Impact

A credit score is very important for home loan approval. It shows how well a person pays back debts. The ideal credit score range for most lenders is between 700 and 750. Scores in this range increase the chance of getting a loan with better interest rates.

Improving your credit score takes time and care. Pay bills on time and keep credit card balances low. Avoid applying for many loans at once. Check your credit report for errors and fix them quickly.

Credit history includes the number of loans, payment timeliness, and debt levels. A longer, positive credit history shows trustworthiness. Late payments or defaults can lower the score and reduce loan chances.

Age And Employment Status

Age limits are key for home loan eligibility. Most lenders ask applicants to be at least 21 years old. The upper age limit usually falls between 60 to 65 years, depending on the lender. This ensures the loan term fits within the borrower’s working years.

Job stability is very important. Lenders prefer borrowers with a steady income. Salaried employees should have worked with the same company for at least 2 years. Self-employed people need to show stable business income for at least 2 to 3 years. This proves they can repay the loan.

The probation period can affect eligibility. Most lenders do not give loans during probation. Some may require probation to be completed. Usually, probation lasts 3 to 6 months. Completing it shows job security.

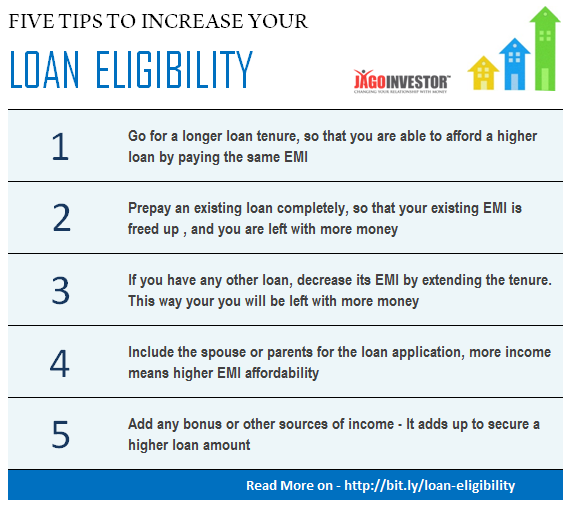

Credit: www.jagoinvestor.com

Loan Amount And Tenure

Maximum Loan-to-Value Ratio (LTV) shows how much loan a bank gives compared to the home’s price. Usually, banks lend up to 80% to 90% of the property’s value. The borrower pays the rest as a down payment. A higher LTV means less money upfront but may have higher interest rates.

Loan Duration Options vary from 5 to 30 years. Choosing a longer tenure lowers monthly payments but increases total interest. Shorter tenure means higher payments but less interest overall. Pick a term that fits your budget and future plans.

Repayment Capacity depends on your monthly income and expenses. Banks check your debt-to-income ratio to decide loan eligibility. They want to ensure you can pay EMIs without stress. Keeping debts low improves your chances of approval.

Property Documentation

Title and Ownership Proof must clearly show the property belongs to the seller. Documents like sale deed, property tax receipts, and encumbrance certificate are needed. They prove the seller has legal rights to sell.

Property Valuation helps lenders decide the loan amount. A professional valuer checks the property’s market value. This ensures the loan matches the property’s worth.

Legal Clearances ensure the property is free from disputes. Approvals from local municipal authorities and no-objection certificates are important. These clearances confirm the property follows all rules.

Co-applicant And Guarantor Role

A co-applicant helps increase the loan amount and approval chances. Their income and credit score add to the main applicant’s profile. This means better eligibility and often lower interest rates.

A guarantor promises to pay if the borrower fails. Typically, they must have a good credit history and steady income. Banks check these points before approval.

| Benefit | Explanation |

|---|---|

| Shared Repayment | Co-applicant shares the loan repayment burden, reducing stress. |

| Higher Loan Amount | Combined incomes allow for a larger loan approval. |

| Better Loan Terms | Stronger financial profiles can lead to lower interest rates. |

Other Eligibility Factors

Existing debt obligations play a big role in home loan eligibility. Banks check how much you owe on credit cards, personal loans, or other debts. Too much debt can lower the amount you can borrow.

Bank relationship matters too. Having a good history with your bank, like savings or fixed deposits, can improve your chances. Banks trust customers with a strong financial record.

Employment type impact is important. Salaried workers usually find it easier to get loans. Self-employed or freelancers may need to show more proof of income. Stability and regular income help banks decide.

Credit: housivity.com

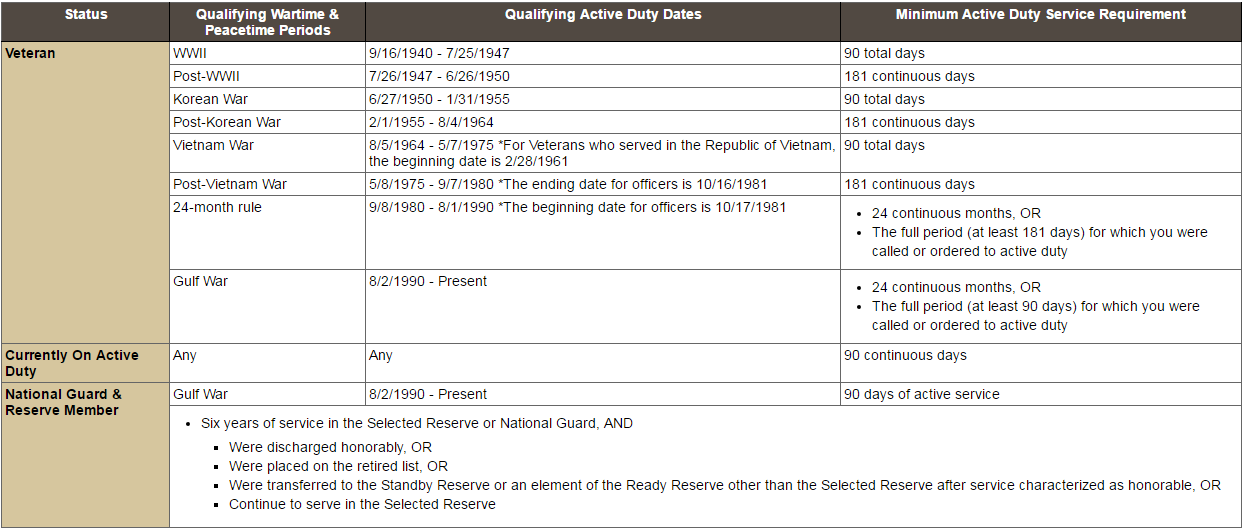

Credit: veterans.nv.gov

Frequently Asked Questions

What Factors Determine Home Loan Eligibility?

Home loan eligibility depends on income, credit score, age, employment status, and existing debts. Lenders evaluate these to assess your repayment ability.

How Does Credit Score Affect Home Loan Approval?

A good credit score improves your chances of approval. It shows lenders you repay debts reliably, leading to better interest rates.

What Is The Minimum Income Required For A Home Loan?

Minimum income varies by lender and loan amount. Generally, a stable monthly income that covers EMIs and living expenses is required.

Can Self-employed Individuals Get Home Loans Easily?

Yes, but self-employed borrowers must provide additional documents like tax returns and business proof. Stability and income consistency are key factors.

Conclusion

Meeting home loan eligibility criteria helps secure your dream home. Check your income, credit score, and documents carefully. Lenders want clear proof you can repay the loan. Keep your finances stable and avoid large debts. Knowing these basics makes the process smoother and faster.

Stay informed and prepare well to improve your chances. A little effort now saves stress later. Remember, understanding rules is key to getting approved.