Are you looking for ways to boost your business, fund your education, or manage your personal finances? Government loan schemes might be the key you’ve been searching for.

These programs are designed to support people like you with easy access to funds, often at low interest rates and flexible terms. Imagine getting the financial help you need without the usual hassle and high costs. You’ll discover how these loan schemes work, who can benefit, and how you can apply to make the most of them.

Keep reading to unlock opportunities that could change your financial future.

Credit: indiaeducationdiary.in

Types Of Government Loan Schemes

Loans for Small Businesses help new or growing businesses get funds easily. These loans often have low interest rates and flexible repayment terms. They support buying equipment, hiring staff, or expanding operations.

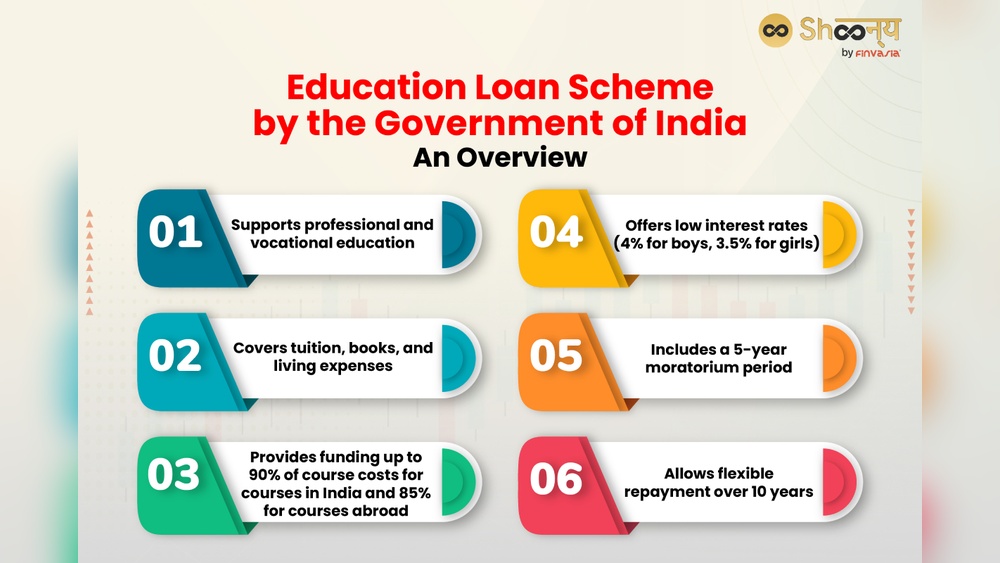

Education Loan Programs assist students with tuition fees, books, and living costs. These loans usually offer long repayment periods and sometimes a grace period after finishing studies.

Housing and Home Improvement Loans provide money to buy a house or improve an existing one. These loans often have lower interest rates and can be paid back in monthly installments over many years.

Agricultural Loan Options support farmers to buy seeds, tools, and equipment. They also help with land development and irrigation systems, often with easy repayment plans.

Loans for Women Entrepreneurs focus on helping women start or grow their businesses. These loans may offer special benefits like lower interest rates or less paperwork.

Eligibility Criteria For Loans

Income requirements vary based on loan type. Usually, borrowers must show a steady income source. Banks check salary slips or business profits. Credit score plays a big role. A good score means better loan chances. Low scores may lead to rejection or higher interest.

Documents needed include ID proof, address proof, and income proof. Some loans require bank statements and tax returns. Employment proof is often mandatory. Documents must be current and valid.

Age limits differ by scheme. Typically, borrowers must be between 18 and 65 years old. Residency status matters too. Many loans require applicants to be citizens or legal residents. Some schemes have specific local residency rules.

Application Process Simplified

You can apply for government loans online or offline. Online applications are faster and easier. Visit the official government website and fill out the form. Upload all required documents like ID proof, income proof, and bank details.

Offline applications need visiting the nearest loan office. Take the application form and submit it with necessary papers. Keep copies of all documents for your records.

| Aspect | Online Application | Offline Application |

|---|---|---|

| Where to Apply | Official website | Loan office or bank branch |

| Time Taken | Usually faster | May take longer |

| Documents | Upload scanned copies | Submit physical copies |

| Convenience | Apply from home | Need to visit office |

Tips for faster approval: Submit all documents correctly. Double-check the form for mistakes. Provide accurate information to avoid delays. Follow up regularly on your application status. Respond quickly if asked for extra details.

Benefits Of Government Loans

Government loans offer lower interest rates compared to private loans. This helps save money over time. Borrowers pay less extra cost on the loan amount.

They come with flexible repayment plans. This means you can choose a payment schedule that fits your income. It reduces stress and makes it easier to pay back.

Some loans include subsidies and grants. These lower the total amount you must repay. Grants do not need to be paid back, helping you financially.

Common Challenges And Solutions

Rejections can happen due to missing documents or low income proof. Checking the application carefully helps avoid mistakes. Asking for feedback after rejection can guide improvements.

Improving credit score takes time but is very important. Paying bills on time and reducing debts helps raise the score. Checking credit reports for errors and fixing them is useful.

Support services offer free advice and help with applications. Local government offices and non-profits provide guidance. Talking to experts can make the process easier and faster.

Credit: www.youtube.com

Success Stories And Case Studies

Entrepreneurs used government loans to start small shops and factories. Many hired local workers and paid back loans on time. Their businesses grew steadily, creating jobs and income.

Students received loans to pay for college and training. They graduated with new skills and found good jobs. This helped them support their families and plan futures.

Farmers expanded farms with loan money. They bought seeds, tools, and machines. Crop yields increased, and farmers earned more. Loans helped them improve their land and produce.

Future Trends In Government Loans

Digital lending platforms make borrowing faster and simpler. People can apply for loans online without visiting banks. These platforms use smart technology to check your details quickly. This saves time and helps more people get loans.

Increased focus on sustainability means loans support eco-friendly projects. Governments want to help businesses that protect the environment. This includes loans for solar energy, clean water, and recycling efforts. Such loans help build a greener future.

| Trend | Description | Benefits |

|---|---|---|

| Digital Lending Platforms | Online systems for easy loan applications | Fast approval, less paperwork |

| Focus on Sustainability | Loans for eco-friendly projects | Supports green businesses, saves environment |

| Expanding Loan Coverage | More loans available for various sectors | Includes small businesses, farmers, and startups |

Expanding loan coverage means more people get support. Farmers, small businesses, and new startups can access funds. This helps grow the economy and create jobs. Loans reach those who needed them most.

Credit: www.youtube.com

Frequently Asked Questions

What Are Government Loan Schemes?

Government loan schemes are financial programs designed to provide low-interest loans. These schemes support various sectors like agriculture, education, and small businesses. They aim to promote economic growth and help underserved communities access credit easily.

Who Is Eligible For Government Loan Schemes?

Eligibility varies by scheme but often includes small businesses, farmers, students, and entrepreneurs. Applicants usually need to meet income limits, provide documentation, and sometimes have a good credit history. Specific criteria depend on the loan program and its objectives.

How To Apply For Government Loan Schemes?

To apply, visit the official government website or designated banks. Complete the application form and submit required documents like ID, income proof, and project details. Follow up regularly for approval status and additional requirements.

What Are The Benefits Of Government Loan Schemes?

Benefits include lower interest rates, flexible repayment options, and minimal collateral requirements. These loans encourage entrepreneurship, education, and rural development. They also help reduce financial burden on borrowers and promote inclusive growth.

Conclusion

Government loan schemes help many people start businesses or buy homes. They offer low interest rates and flexible terms. Understanding the options can save time and money. Always check the eligibility before applying. These loans support education, agriculture, and small industries too.

Taking a loan carefully can improve your financial situation. Stay informed about new schemes regularly. A smart choice today can lead to a better tomorrow.