Are you planning to take a loan but unsure how much you’ll need to pay each month? A Loan EMI Calculator can be your best friend in this situation.

It helps you see your monthly payments clearly, so you can plan your budget without any surprises. Imagine having the power to control your finances and make smarter decisions before you commit. Keep reading to discover how this simple tool can save you time, reduce stress, and put you in charge of your loan journey.

What Is A Loan Emi Calculator

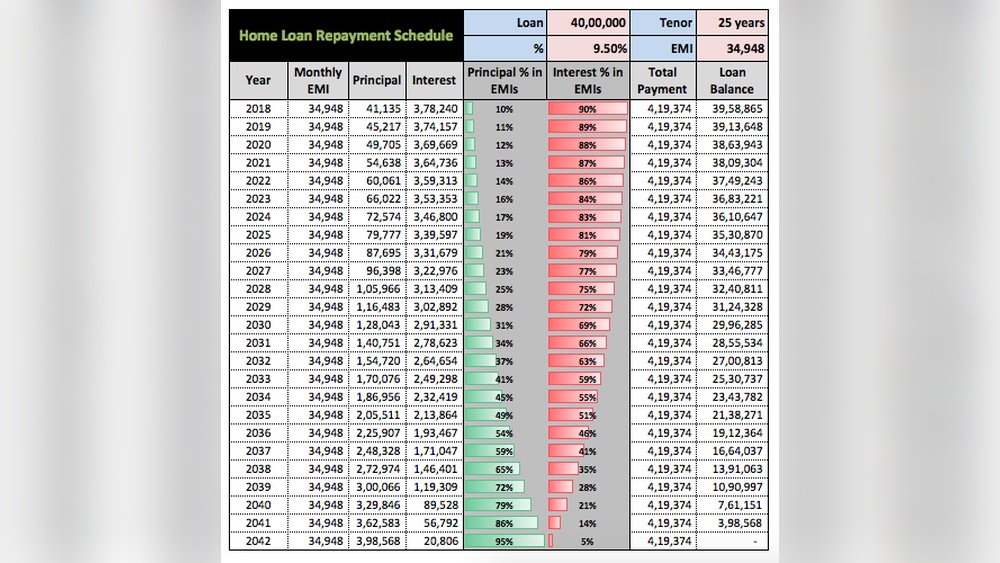

A Loan EMI Calculator helps find the monthly payment for a loan. It uses the loan amount, interest rate, and loan term to calculate the EMI (Equated Monthly Installment). This tool shows how much you pay every month.

It saves time and avoids mistakes in manual calculations. The calculator helps plan your budget by showing exact numbers. You can try different loan amounts or terms to see how payments change. This way, it is easy to pick a loan that fits your needs.

Credit: www.youtube.com

Benefits Of Using An Emi Calculator

Using an EMI calculator helps plan your loan payments clearly. It shows the monthly amount you must pay. This helps avoid surprises later. You can test different loan amounts and tenures. This way, you find what fits your budget best.

The calculator saves time by doing quick math. It also helps compare loans from different banks. You get a clear view of total interest costs. This helps make smarter choices about borrowing.

Key Factors Affecting Emi

Loan Amount is the total money you borrow. Higher loan amounts mean higher EMIs. Lower amounts reduce your monthly payment.

Interest Rate affects how much extra you pay. A higher rate increases your EMI. A lower rate saves you money.

Loan Tenure is the time to repay the loan. Longer tenure means smaller EMIs but more interest paid. Shorter tenure means higher EMIs but less interest overall.

Credit: razorpay.com

Step-by-step Guide To Calculate Emi

Start by gathering important loan details. These include the loan amount, interest rate, and loan tenure. Having these ready saves time.

Select a reliable EMI calculator tool. Many websites and apps offer free calculators. Choose one that is easy to use.

Enter your loan amount, interest rate, and tenure into the calculator. Double-check the numbers to avoid mistakes.

After submitting, the calculator shows your monthly EMI payment. This helps plan your budget better. You can also adjust inputs to see different payment options.

Tips To Lower Your Emi

Increasing loan tenure spreads out payments over more months. This lowers your monthly EMI but raises total interest paid. Choose a tenure you can manage without extra stress.

Negotiating interest rates can save a lot of money. Talk to your lender and ask for a lower rate. Even a small drop reduces your EMI and total cost.

Making prepayments helps cut down your loan faster. Pay extra money when you can. It lowers the principal and shrinks future EMIs.

Common Mistakes To Avoid

Avoid entering wrong loan amount or interest rate. This leads to incorrect EMI results. Double-check all details before calculating. Many forget to set the loan tenure properly. This changes monthly payments a lot. Some use EMI calculators that do not include processing fees or extra charges. This gives a lower EMI than actual.

Ignoring the impact of prepayment options is another common mistake. Prepayments can reduce overall interest and tenure. Not considering this can cause surprise costs later. Also, some assume EMI stays the same even if rates change. Many loans have variable interest rates. This means EMI can go up or down.

Always use a trusted EMI calculator from reliable sources. Avoid calculators that look too complex or ask for too much personal data. Simple and clear tools work best for most users.

Credit: www.youtube.com

Frequently Asked Questions

What Is A Loan Emi Calculator?

A loan EMI calculator is an online tool that helps you estimate monthly loan payments. It uses loan amount, interest rate, and tenure to calculate EMIs quickly and accurately.

How Does A Loan Emi Calculator Work?

It applies the loan amount, interest rate, and tenure in a standard formula. The calculator then provides the exact monthly installment you need to pay.

Why Use A Loan Emi Calculator Before Applying?

Using an EMI calculator helps you plan finances by understanding monthly obligations. It prevents surprises and aids in selecting affordable loan options.

Can I Adjust Interest Rates In The Emi Calculator?

Yes, you can input different interest rates to see how they affect your monthly payments. This helps in comparing various loan offers effectively.

Conclusion

Using a loan EMI calculator helps plan your finances better. It shows how much you pay each month. You can compare different loan options easily. It saves time and avoids surprises later. Clear numbers make decisions simple and smart. Try the calculator before choosing any loan.

Manage your money with confidence and ease. A small tool with big benefits.