Are you looking to borrow money without feeling weighed down by high interest rates? A low interest personal loan could be exactly what you need.

Imagine having extra cash for your urgent expenses, a dream vacation, or even debt consolidation—without the stress of soaring monthly payments. You’ll discover how to find the best low interest personal loan, what to watch out for, and tips to secure rates that save you money.

Keep reading to take control of your finances and make smart borrowing decisions that work in your favor.

Benefits Of Low Interest Personal Loans

Lower monthly payments make it easier to manage finances. Paying less interest means more money stays in your pocket. This reduces stress and helps avoid late fees.

Reduced overall cost means paying back less money over time. A low interest rate saves a lot compared to high interest loans. This keeps your total debt smaller and easier to handle.

Improved budget management happens when payments are clear and affordable. You can plan your expenses better without surprises. This creates financial stability and peace of mind.

Types Of Personal Loans With Low Interest

Secured personal loans need collateral like a car or house. They often have lower interest rates because lenders have less risk. Borrowers must repay on time to keep their assets safe.

Unsecured personal loans do not require collateral. These loans usually have higher interest rates since lenders take more risk. They rely on the borrower’s credit score and income.

Peer-to-peer lending options connect borrowers with individual lenders online. Interest rates can be competitive, often lower than banks. The process is fast and simple, with less paperwork.

Eligibility Criteria For Low Interest Loans

Credit score is very important for low interest loans. A higher score means better chances of approval. Usually, a score above 650 is good. Lenders use this to check how well you pay back money.

Income verification shows lenders you can repay the loan. They ask for pay stubs, bank statements, or tax returns. Stable income makes lenders trust you more.

Debt-to-income ratio compares your monthly debt to your income. A lower ratio means you owe less money compared to what you earn. Most lenders want this ratio below 40% to approve loans.

Credit: www.livemint.com

How To Find The Best Loan Rates

Comparing lenders helps find the lowest interest rates. Check banks, credit unions, and online lenders. Look at APR, fees, and loan terms. Each lender offers different deals. Small differences can save money.

Using online loan calculators shows monthly payments and total costs. Enter loan amount, interest rate, and term. See how changes affect payments. It helps choose the best loan size and length.

Negotiating loan terms can lower costs. Ask for a better rate or fewer fees. Some lenders are open to talk. Be polite but firm. Even small changes reduce what you pay.

Steps To Apply For A Low Interest Personal Loan

Gather all important documents like ID proof, address proof, and income proof. These help prove your identity and financial status. Keep your bank statements and salary slips ready too.

Fill out the loan application form carefully. Provide accurate details about your personal information, income, and loan amount. Mistakes can cause delays or rejection.

The loan approval process includes verification of your documents and credit history. The lender checks if you can repay the loan. This step may take a few days.

Credit: www.sofi.com

Common Uses For Low Interest Personal Loans

Debt consolidation helps combine several debts into one. This makes payments easier and often lowers interest rates. Many choose personal loans for this reason. It can reduce monthly bills and stress.

Home improvement is another common use. People borrow money to fix or upgrade their homes. This can increase home value and comfort. Projects like kitchen or bathroom updates are popular choices.

Medical expenses can be costly and unexpected. Low interest personal loans provide funds to cover bills quickly. They help avoid high credit card rates or delayed treatments.

Risks And Considerations

Low interest personal loans may have hidden fees. These include late payment fees, processing charges, and prepayment penalties. Always check the loan agreement carefully before signing.

Taking a loan affects your credit score. Missing payments or defaulting can lower your score. A low credit score makes future borrowing harder and more expensive.

Predatory lending means unfair or abusive loan terms. Be wary of lenders asking for upfront fees or offering loans without checking your ability to repay. Such loans can trap you in debt.

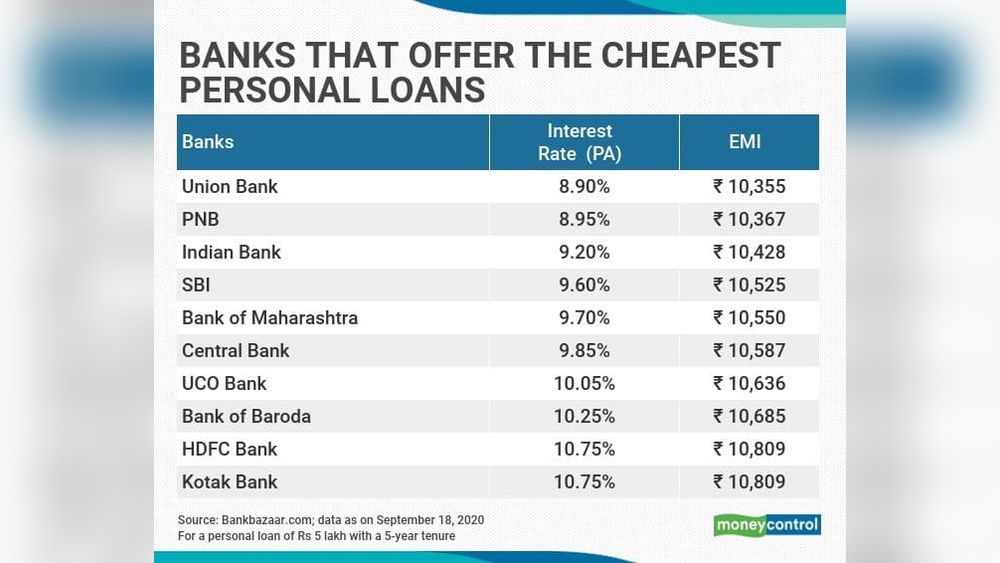

Credit: www.moneycontrol.com

Tips To Maintain Low Interest Rates

Timely repayments help keep interest rates low. Paying on time shows lenders you are responsible. This builds trust and can lead to better loan terms. Late payments may increase your rate or harm your credit score.

Maintaining good credit is key. A higher credit score often means lower interest rates. Pay bills on time and keep credit card balances low. Avoid taking too many loans at once.

Refinancing opportunities can lower your interest rate. Look for loans with better rates after some time. Refinancing can reduce monthly payments and total interest paid. Always compare new loan offers carefully before switching.

Frequently Asked Questions

What Is A Low Interest Personal Loan?

A low interest personal loan offers borrowing at reduced rates. It helps save money on interest payments and suits various financial needs like emergencies or debt consolidation.

How To Qualify For A Low Interest Personal Loan?

Qualify by having a good credit score, stable income, and low debt. Lenders assess your creditworthiness before offering low interest rates and loan approval.

Can I Use A Low Interest Personal Loan For Any Purpose?

Yes, most low interest personal loans are unsecured and flexible. You can use them for home improvements, medical bills, education, or travel expenses.

How Does Loan Tenure Affect Interest Rates?

Longer loan tenure often means higher interest rates. Shorter terms usually have lower rates, helping you save on total interest paid.

Conclusion

Choosing a low interest personal loan saves money on interest payments. It helps manage expenses without straining your budget. Compare offers from different lenders carefully. Check the loan terms and fees before deciding. A lower rate means lower monthly payments.

This makes repaying the loan easier and faster. Plan your loan amount based on your real needs. Keep track of payments to avoid extra charges. A smart choice today can ease financial stress tomorrow.