Are you planning to take out a loan but unsure how much you’ll really pay back? Using a loan calculator online can save you from surprises and stress.

It helps you see your monthly payments, total interest, and the full cost before you commit. Imagine making smart decisions with clear numbers right at your fingertips. Keep reading to discover how this simple tool can put you in control of your money and help you choose the best loan for your needs.

Benefits Of Using Online Loan Calculators

Online loan calculators help you save time and effort. You can get quick results without doing hard math. Just enter a few numbers, and the calculator shows your monthly payments and total interest. This helps you avoid confusion and guesswork.

Using these tools makes financial planning easier. You can see how different loans affect your budget. It helps you decide how much you can borrow safely. You also get a clear picture of how long it will take to repay the loan.

Loan calculators let you compare loan options easily. You can check different interest rates and terms side by side. This helps you pick the best deal for your needs. No need to visit banks or wait for answers.

Credit: www.thecalculatorsite.com

Types Of Loan Calculators Available

Mortgage calculators help estimate monthly payments on home loans. They show how interest rates and loan terms affect payments. This tool helps plan budgets before buying a house.

Auto loan calculators work for car financing. They calculate monthly costs based on loan amount, interest, and time. Users can see how much they pay over the loan period.

Personal loan calculators show costs for loans used for many purposes. They help understand payment schedules and total interest paid. It makes borrowing clearer and easier to manage.

Student loan calculators assist with education loan planning. They estimate payments based on loan size, interest, and repayment time. Useful for managing student debt and future finances.

Key Features To Look For

A user-friendly interface helps people enter data easily. Clear buttons and simple menus make the process smooth. This saves time and avoids mistakes.

Accurate interest calculations ensure the loan cost is correct. This helps users plan their payments well. Wrong numbers can cause big problems later.

Customizable loan terms allow users to change loan length and amount. This flexibility fits different needs and budgets. It gives a clear picture of loan options.

Amortization schedules show payment plans over time. They break down how much goes to interest and principal. This helps track loan progress and balance.

Credit: www.servivuelo.com

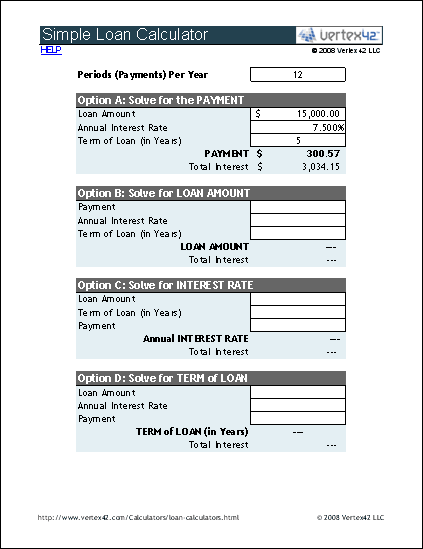

How To Use A Loan Calculator Effectively

Start by entering the loan amount, interest rate, and loan term. These details must be accurate for correct results.

Next, review the payment breakdown. It shows how much goes to principal and interest each month. This helps understand total costs.

Try changing variables like interest rate or loan term to see how payments change. This helps find the best plan for your budget.

Popular Free Loan Calculator Tools Online

Many bank websites offer free loan calculators. These tools help users find monthly payments and total interest. You just enter the loan amount, interest rate, and term. Results show how much you pay each month. It’s quick and easy. No cost involved.

Financial service platforms also provide loan calculators. These platforms compare different loan offers side by side. They help users choose the best deal. Some tools show detailed payment schedules and extra payment options. Very useful for planning.

Mobile apps make loan calculations handy. You can calculate loans anytime, anywhere. Apps often include reminders for payment dates. Some let you save different loan scenarios. Perfect for people on the go.

Common Mistakes To Avoid

Extra fees like processing or late payment charges can add up fast. Many people forget to include these in their calculations. This mistake leads to underestimating the total loan cost. Always ask about fees before you use a loan calculator.

Loan terms such as length and type affect monthly payments. Ignoring these can give wrong results. For example, a longer term may lower monthly payments but increase total interest paid. Check the loan term details carefully.

Interest rates change often. Using old or wrong rates gives false estimates. Make sure to enter the current interest rate from your lender. This keeps your calculation accurate and helpful.

Tips For Choosing The Right Loan Calculator

Regular updates keep the loan calculator reliable and accurate. New rules or interest rates change often. Updated tools reflect these changes quickly. Check the last update date before use.

User reviews give real opinions about the calculator. They show if the tool is easy to use and if results are trustworthy. Look for many positive reviews with detailed feedback.

Calculation accuracy is vital. The calculator must give correct numbers for your loan amount, interest, and term. Test the tool with known values to see if results match your expectations.

Credit: www.vertex42.com

Frequently Asked Questions

What Is A Loan Calculator Online?

A loan calculator online is a tool that helps estimate loan payments. It calculates monthly installments based on loan amount, interest rate, and term. This tool aids in planning finances and comparing loan options quickly and accurately.

How Does An Online Loan Calculator Work?

An online loan calculator uses your inputs like loan amount, interest rate, and loan duration. It applies standard formulas to compute monthly payments and total interest. This helps borrowers understand repayment schedules before applying for loans.

Can I Use A Loan Calculator For Different Loan Types?

Yes, loan calculators support various loan types including personal, auto, and mortgage loans. They adjust calculations based on loan-specific terms and interest rates. This flexibility helps users assess different loan scenarios easily.

Why Should I Use A Loan Calculator Before Borrowing?

Using a loan calculator helps you budget by showing exact monthly payments and total costs. It prevents surprises and aids in comparing loan offers. This ensures informed decisions and better financial management.

Conclusion

Using a loan calculator online helps you plan your finances better. It shows monthly payments clearly and fast. You can compare different loan options easily. This tool saves time and reduces mistakes. It makes borrowing money less stressful. Try a loan calculator before you decide.

It helps you understand what you can afford. Smart choices start with simple steps like this. Keep your money plans clear and simple.