Are you thinking about applying for a personal loan but unsure if you qualify? Knowing your personal loan eligibility can save you time, stress, and even protect your credit score.

Imagine getting the funds you need quickly, without endless paperwork or rejections. This guide will show you exactly what lenders look for and how to check your eligibility easily. By understanding these key factors, you can boost your chances of approval and get closer to your financial goals.

Keep reading to discover how to make your personal loan application a smooth and successful experience.

Credit: faircentp2p.weebly.com

Eligibility Criteria For Personal Loans

Most lenders require applicants to be between 21 and 60 years old. Borrowers must have a steady monthly income, usually above a certain minimum. This shows the ability to repay the loan on time.

A good credit score helps get loan approval faster. Scores above 650 are often preferred. A higher score can mean better interest rates and loan terms.

Employment status is key. Salaried employees, self-employed, and professionals can apply. Lenders check job stability and income consistency to reduce risk.

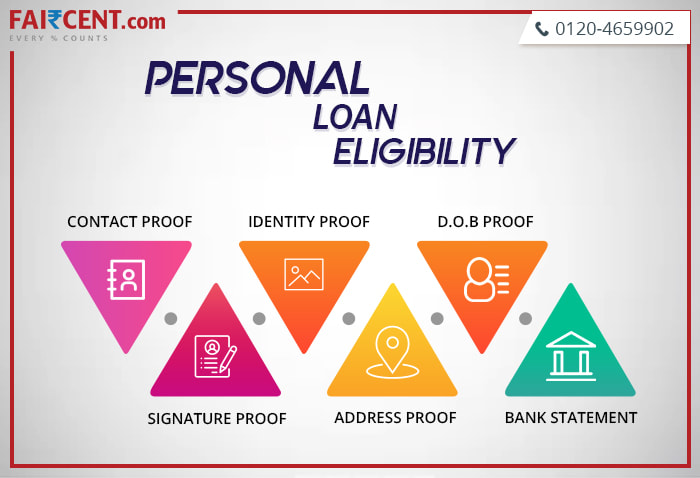

Common documents needed include ID proof, address proof, income proof like salary slips or bank statements, and sometimes employer details. These help verify identity and financial status.

Ways To Improve Credit Score

Paying bills on time shows lenders you are responsible. Late payments can lower your credit score. Set reminders or use automatic payments to avoid missing due dates.

Reducing the money you owe helps improve your credit. Try to pay off credit cards and loans steadily. Keep balances low compared to your credit limits.

Errors in your credit report can hurt your score. Check your report regularly for mistakes. Report wrong information to credit bureaus to get it fixed quickly.

Choosing The Right Loan Amount

Choosing the right loan amount depends on your repayment capacity. Calculate your monthly income and expenses carefully. This helps to know how much you can pay back every month without stress.

Avoid borrowing more than you can repay. Over-borrowing leads to financial trouble and high interest payments. Keep your loan amount within your budget.

| Factor | Details |

|---|---|

| Monthly Income | Sum of all earnings before expenses |

| Monthly Expenses | Rent, food, bills, and other costs |

| Affordable EMI | Amount you can comfortably pay every month |

| Loan Amount | Based on EMI and loan tenure |

Credit: www.ruloans.com

Tips For Strong Loan Applications

Providing correct and complete information helps lenders process loans faster. Double-check all details like name, address, and income. Mistakes can delay approval or cause rejection.

Including co-applicants or guarantors can improve loan chances. They share responsibility and add financial strength. This reduces risk for lenders and increases approval odds.

| Stable Income Sources | Why It Matters |

|---|---|

| Regular Salary | Shows steady ability to repay loan monthly |

| Business Income | Proves ongoing cash flow and financial health |

| Rental Income | Provides extra money to cover loan payments |

Stable income reassures lenders about your repayment capacity. Proof like payslips or bank statements strengthens your application.

Using Online Eligibility Tools

Online eligibility tools help check if you can get a personal loan. These tools ask for basic details like income, age, and credit score. They quickly show if you qualify without affecting your credit.

Pre-approval checks save time and effort. They give a clear idea of loan amounts and interest rates you might get. This helps plan your budget better and avoid surprises later.

To use an eligibility calculator, enter your monthly income, expenses, loan amount, and loan term. The tool then estimates your eligibility and possible monthly payments. Results appear in seconds, making the process easy and fast.

Common Reasons For Loan Rejection

Low credit score often leads to loan rejection. It shows lenders a history of missed payments or debts. A score below the lender’s minimum is risky for them.

Incomplete documentation can stop the loan process. Missing ID, income proof, or address details can delay or deny approval. Lenders need full papers to verify identity and income.

High debt-to-income ratio means too much debt compared to income. Lenders worry about your ability to repay the loan. Keeping debts low helps improve chances.

Credit: navi.com

Frequently Asked Questions

What Factors Determine Personal Loan Eligibility?

Lenders assess income, credit score, employment status, and debt-to-income ratio. These factors ensure you can repay the loan reliably and on time.

How Can I Check My Personal Loan Eligibility Online?

Visit the lender’s website and use their eligibility calculator. Enter basic details like income, employment, and credit score for instant results.

Does Credit Score Affect Personal Loan Eligibility?

Yes, a higher credit score improves your chances. It reflects your creditworthiness and repayment history, influencing loan approval and interest rates.

Can Self-employed Individuals Get Personal Loans Easily?

Yes, but they must provide proof of stable income and financial documents. Lenders may require additional paperwork compared to salaried applicants.

Conclusion

Checking your personal loan eligibility saves time and effort. It helps you know what lenders expect. You can prepare your documents and improve your chances. Understanding eligibility makes the loan process clear and simple. Stay honest about your income and debts.

This builds trust with lenders and speeds approval. Always review your credit score before applying. A good score often means better loan terms. Keep your information ready to avoid delays. Start your eligibility check today for smart borrowing choices.