When you need extra money, choosing the right loan can feel confusing. You’ve probably heard about secured and unsecured loans, but which one is better for you?

Understanding the difference can save you time, money, and stress. This article will break down what each loan means, how they affect your finances, and what you should watch out for. By the end, you’ll know exactly which option fits your needs—and how to make the smartest choice for your future.

Keep reading to take control of your financial decisions today.

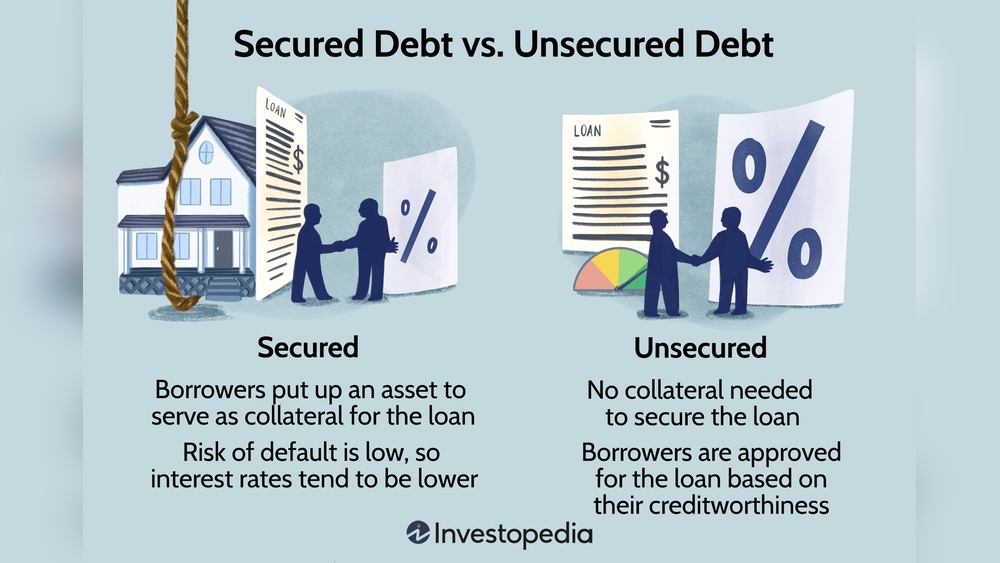

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Credit: www.investopedia.com

What Is A Secured Loan

A secured loan is a type of loan backed by collateral. Collateral is something valuable that the lender can take if the borrower does not repay the loan. This helps reduce the risk for the lender.

There are several types of secured loans. Common ones include mortgages, where a house is used as collateral. Auto loans use a car as security. Home equity loans let people borrow against their home’s value.

| Type of Secured Loan | Common Collateral Used |

|---|---|

| Mortgage | House or Property |

| Auto Loan | Car or Vehicle |

| Home Equity Loan | Home Equity or Property Value |

| Secured Personal Loan | Bank Savings or Investments |

What Is An Unsecured Loan

An unsecured loan is a type of loan without any collateral. Borrowers do not need to offer property or assets. These loans rely on the borrower’s creditworthiness and ability to repay.

Common types include personal loans, credit cards, and student loans. They usually have higher interest rates than secured loans. This is because lenders take more risk without collateral.

| Loan Type | Purpose | Typical Term |

|---|---|---|

| Personal Loan | Any personal expense | 1 to 5 years |

| Credit Card | Short-term purchases | Revolving credit |

| Student Loan | Education costs | 5 to 20 years |

Eligibility depends on income, credit score, and employment. Lenders want to see steady income and good credit history. Lower credit scores may lead to higher interest rates or rejection.

Interest Rates Comparison

Secured loan rates are usually lower than unsecured loans. This is because secured loans use assets like a house or car as collateral. Lenders feel safer lending this way. The borrower’s credit score, loan term, and the value of the collateral affect the rate. If the collateral is valuable, rates tend to be lower.

Unsecured loan rates depend more on the borrower’s credit history and income. Since there is no collateral, lenders take more risk. This leads to higher interest rates. Borrowers with good credit get better rates. Loan size and term also influence the rate.

Credit: www.self.inc

Loan Approval Process

Secured loans require more documents because they use property as collateral. Common papers include proof of ownership, income statements, and identity proof. These documents help lenders check the borrower’s ability to repay and the value of the asset.

Unsecured loans need fewer documents, mostly income proof, identity, and address verification. This speeds up the approval process but may come with higher interest rates.

| Loan Type | Typical Documentation | Approval Time |

|---|---|---|

| Secured Loan | Proof of ownership, income proof, ID, collateral papers | Several days to weeks |

| Unsecured Loan | Income proof, ID, address proof | Few hours to days |

Risks And Benefits

Secured loans often have lower interest rates. They use property or assets as collateral. This makes them safer for lenders. Borrowers can get larger loan amounts and longer repayment terms. These loans can help build credit when paid on time. The risk is losing the collateral if payments are missed.

Unsecured loans need no collateral. They are easier and quicker to get. Good for borrowers without valuable assets. Interest rates tend to be higher because of the risk for lenders. Loan amounts are usually smaller. These loans depend on credit score and income.

Risks include higher interest rates for unsecured loans. Missed payments on secured loans may lead to loss of property. Both types require responsible repayment to avoid credit damage. Choose based on your financial situation and ability to repay.

Repayment Terms

Secured loans usually have longer repayment tenures. These can last from 5 to 30 years, depending on the loan type and amount. This longer time helps lower monthly payments, making it easier to manage money.

Unsecured loans tend to have shorter repayment periods, often between 1 and 5 years. Shorter terms mean higher monthly payments but less total interest paid.

| Loan Type | Typical Tenure | Repayment Flexibility |

|---|---|---|

| Secured Loan | 5 to 30 years | Less flexible, fixed monthly payments |

| Unsecured Loan | 1 to 5 years | More flexible, may allow early repayment |

Choosing The Right Loan

Secured loans need collateral, like a house or car. This lowers the interest rates. But, the risk is losing the item if payments stop.

Unsecured loans do not require collateral. They are faster to get but usually have higher interest rates. Good for small amounts or short-term needs.

Assess your finances carefully. Choose secured loans for big expenses like buying a home. Use unsecured loans for smaller needs or emergencies.

| Type of Loan | Collateral Needed | Interest Rate | Best For |

|---|---|---|---|

| Secured Loan | Yes | Lower | Big purchases, long-term loans |

| Unsecured Loan | No | Higher | Small amounts, short-term needs |

Credit: clarifycapital.com

Frequently Asked Questions

What Is The Difference Between Secured And Unsecured Loans?

Secured loans require collateral, like property or assets, as security. Unsecured loans don’t need collateral but usually have higher interest rates due to higher risk for lenders.

Which Loan Type Has Lower Interest Rates?

Secured loans generally have lower interest rates because the collateral reduces lender risk. Unsecured loans carry higher rates due to lack of security.

Can Unsecured Loans Affect My Credit Score?

Yes, both loan types impact your credit score. Timely payments improve your score, while defaults can harm it significantly.

What Are Common Examples Of Secured Loans?

Common secured loans include mortgages, auto loans, and home equity loans. These loans use assets as collateral for approval.

Conclusion

Choosing between secured and unsecured loans depends on your needs. Secured loans often have lower interest rates and require collateral. Unsecured loans do not need collateral but may cost more. Consider your financial situation carefully before deciding. Understand the risks and benefits of each loan type.

Making an informed choice helps avoid future problems. Always borrow within your means and plan repayment. This way, you manage debt safely and confidently.