Are you worried about how to pay for your studies? An education loan for students might be the key to unlocking your dreams.

Imagine focusing on your courses without the constant stress of money. This guide will show you how to get the right loan, what to look out for, and how it can make a real difference in your life. Keep reading to discover how you can secure the support you need to achieve your goals.

Credit: www.eduloans.org

Types Of Education Loans

Government loans usually have lower interest rates and flexible repayment plans. They are easier to get for domestic students. These loans often cover tuition, books, and living costs. Private loans come from banks or lenders. They may have higher rates and need a credit check or co-signer. Private loans can be used if government loans are not enough.

Domestic students can apply for many types of loans. Some loans are based on financial need. Others depend on credit history. Scholarships and grants might reduce how much loan is needed.

For international students, loans are harder to get. Many lenders want a co-signer who is a local citizen. Some banks offer special loans for international students. These loans may have higher interest rates and shorter repayment times.

Credit: studentaid.gov

Eligibility Criteria

Academic requirements usually include being enrolled in a recognized school or college. Students must maintain a minimum grade level or score to qualify. Some lenders need proof of good academic standing. This shows the student can succeed in their studies.

Income and credit score play a big role in loan approval. Lenders check the borrower’s or co-signer’s income to see if they can repay the loan. A higher credit score often means better chances for loan approval and lower interest rates.

Co-signer and collateral needs vary by lender. Many loans need a co-signer with a stable income and good credit. Some loans require collateral, like property or assets, to secure the loan. This reduces the lender’s risk.

Application Process

Required documents usually include identity proof, address proof, admission letter, and income proof. Sometimes, a passport-sized photo and academic records are needed. Keep these ready to speed up the process.

Step-by-step application starts with filling out the loan form carefully. Attach all required documents. Submit the form online or at the bank branch. Wait for verification and approval. After approval, sign the loan agreement.

Common mistakes to avoid include submitting incomplete forms or missing documents. Avoid providing wrong information. Do not delay in submitting papers. Check all details twice before submission. Clear communication with the bank helps avoid confusion.

Credit: www.bankrate.com

Tips For Easy Approval

Improving creditworthiness helps gain trust from lenders. Pay bills on time. Keep credit card balances low. Avoid taking many loans at once. A steady income or a co-signer can boost approval chances.

Choosing the right lender saves time and money. Compare interest rates and loan terms carefully. Check lender reviews and customer service. Some lenders offer flexible repayment plans that fit your budget better.

Preparing a strong loan proposal makes a big difference. Include clear details about your course and fees. Show your ability to repay the loan. Attach documents like admission letters and income proof. A neat and complete proposal builds confidence.

Repayment Plans And Strategies

Grace periods give students time to start paying loans after school ends. Usually, this time lasts six months. During this period, no payments or interest may be required. Deferment allows temporary pause on payments due to financial hardship or returning to school. Interest may or may not grow depending on the loan type.

Income-based repayment plans adjust monthly payments to match income. Payments stay low when income is small and rise as earnings increase. This helps borrowers manage payments without stress.

Early repayment reduces total interest paid. Paying extra or paying off loans early saves money over time. Some loans have no penalties for early payments, so it’s smart to pay more when possible.

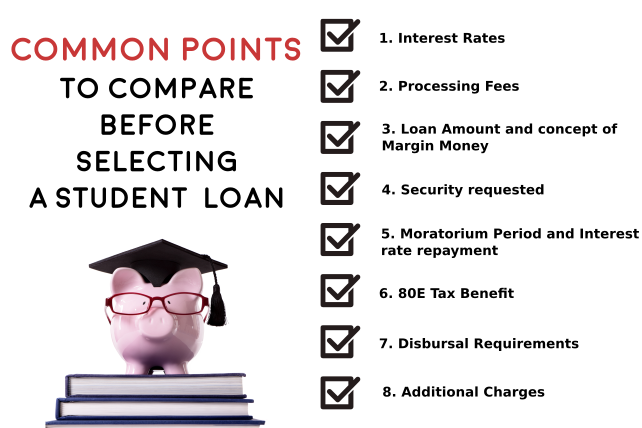

Interest Rates And Fees

Fixed interest rates stay the same during the loan period. This means monthly payments do not change. Variable rates can go up or down based on the market. This might make payments higher or lower over time.

Some loans have hidden charges like processing fees, late payment fees, or prepayment penalties. These extra costs can add up. Always ask for a full list of fees before choosing a loan.

| Loan Feature | Fixed Rate | Variable Rate |

|---|---|---|

| Interest Stability | Constant | Can change |

| Monthly Payment | Same every month | May go up or down |

| Risk Level | Low risk | Higher risk |

| Possible Savings | Less chance | Possible if rates fall |

Comparing loan offers means checking rates, fees, and repayment terms. Some loans have better deals but more fees. Others have low rates but strict rules. Choose what fits your budget and plans.

Alternatives To Education Loans

Scholarships and grants offer free money for college. They do not need to be paid back. Many schools and groups give them based on grades, skills, or financial need. Applying early can increase chances.

Work-study programs let students earn money by working part-time. Jobs are often on campus and flexible with class times. This helps pay for books and small expenses.

Crowdfunding and sponsorships let students ask others for help. Websites allow sharing stories and goals to get support. Local businesses or community groups may also sponsor students with funds.

Frequently Asked Questions

What Is An Education Loan For Students?

An education loan helps students cover tuition and related expenses. It offers low-interest rates and flexible repayment options. This loan supports higher studies domestically or abroad, easing financial burdens.

Who Is Eligible For An Education Loan?

Eligibility depends on the student’s admission to a recognized institution. The applicant or co-applicant must have a good credit score. Income and academic records are also considered by lenders.

How Much Can I Borrow With An Education Loan?

Loan amounts vary based on course fees and living expenses. Typically, banks cover up to 90% of total costs. The remaining amount usually needs to be paid by the student.

What Documents Are Required For An Education Loan?

Common documents include admission proof, identity proof, address proof, and income statements. Academic records and co-applicant details are also necessary. These help lenders verify eligibility and assess risk.

Conclusion

Education loans help many students reach their dreams. They pay for tuition, books, and living costs. Choosing the right loan means checking interest rates and repayment plans. Planning ahead avoids money problems later. Students can focus on studies, not just funds.

A loan is a step toward a brighter future. Make smart choices and stay informed. Education loans support learning and growth. Take time to understand your options well. Success starts with good financial decisions.