Are you thinking about applying for a loan but feel unsure where to start? The loan application process might seem confusing, but it doesn’t have to be.

Understanding each step can save you time, reduce stress, and increase your chances of approval. This guide will walk you through the loan application process in simple terms, helping you make smart decisions with confidence. Keep reading to discover how you can navigate the process smoothly and get the funds you need without unnecessary hassle.

Credit: edrawmax.wondershare.com

Preparing Your Documents

Gathering all required documents speeds up your loan process. Common papers include proof of income, bank statements, and identification. Keep your financial records neat and organized for easy access.

Check your credit score ahead of time. A good score increases your chance of approval. You can get your score from many free online services. Fix any errors you find on your credit report quickly.

| Required Documents | Purpose |

|---|---|

| Proof of Income | Shows you can repay the loan |

| Bank Statements | Shows your spending and saving habits |

| Identification | Confirms your identity |

| Credit Report | Displays your credit history and score |

Choosing The Right Loan

Types of loans include personal, home, auto, and student loans. Each serves different needs. Personal loans work for many purposes. Home loans help you buy a house. Auto loans are for cars. Student loans cover education costs.

Interest rates show how much extra you pay. Lower rates save money. Fixed rates stay the same. Variable rates can change over time. Check if rates are simple or compound.

Loan terms mean how long you have to repay. Short terms have higher payments but less total cost. Longer terms have lower payments but cost more interest. Look at fees and penalties too. Choose terms that fit your budget and plans.

Filling Out The Application

Provide accurate personal information. Double-check your full name, date of birth, and contact details. This helps avoid delays.

List your current job and income clearly. Include employer name, job title, and monthly earnings. Be honest about your income to prevent issues.

Common errors include typos, missing fields, and wrong numbers. Always review the form before submitting. Fix mistakes early to save time.

Submitting Your Application

Submitting a loan application can be done online or in-person. Online submission is fast and easy. You fill out forms on a website and upload needed documents. In-person submission lets you talk to a loan officer directly. This can help if you have questions. Both ways need accurate information to avoid delays.

Tracking your application is simple. Most lenders give a tracking number or an online portal. Check your status often to see if more info is needed. This helps keep your application moving.

Sometimes, lenders ask for extra documents or details. Respond quickly to avoid delays. Keep copies of everything you send. Being prompt shows you are serious and organized.

Speeding Up Approval

Clear and honest communication with lenders speeds up the process. Always provide accurate information and respond quickly to questions. Keep important documents like ID, income proof, and bank statements ready. This helps lenders verify your details faster.

Using pre-approval options can save time. It shows lenders you are serious and meet basic criteria. Pre-approval also helps you understand how much loan you can get. This step can shorten the final approval time.

After Approval Steps

Reviewing the loan agreement is a very important step. Read every line carefully. Check the interest rate, fees, and terms. Ask questions if anything is unclear. Signing means you agree to all conditions.

The repayment schedule shows when and how much to pay. Keep it safe. Plan your budget around these dates. Paying on time helps keep your credit good.

Receiving funds usually happens after signing. Money may come as a deposit or check. Use the loan for the agreed purpose only. Track spending to stay on budget.

Common Challenges And Solutions

Loan rejections often happen due to low credit scores or missing documents. Staying calm and asking the lender for clear reasons helps. Fixing errors on your credit report improves chances next time. Saving money to reduce debt also boosts your profile.

Improving credit means paying bills on time. Avoid borrowing more than you can repay. Check your credit report regularly for mistakes. A better score opens doors to more loan options and better rates.

| Avoiding Application Pitfalls | Tips |

|---|---|

| Incomplete Forms | Double-check all fields before submitting. |

| Wrong Information | Use accurate, up-to-date details only. |

| Ignoring Terms | Read loan terms carefully to avoid surprises. |

| Late Submission | Submit your application before deadlines. |

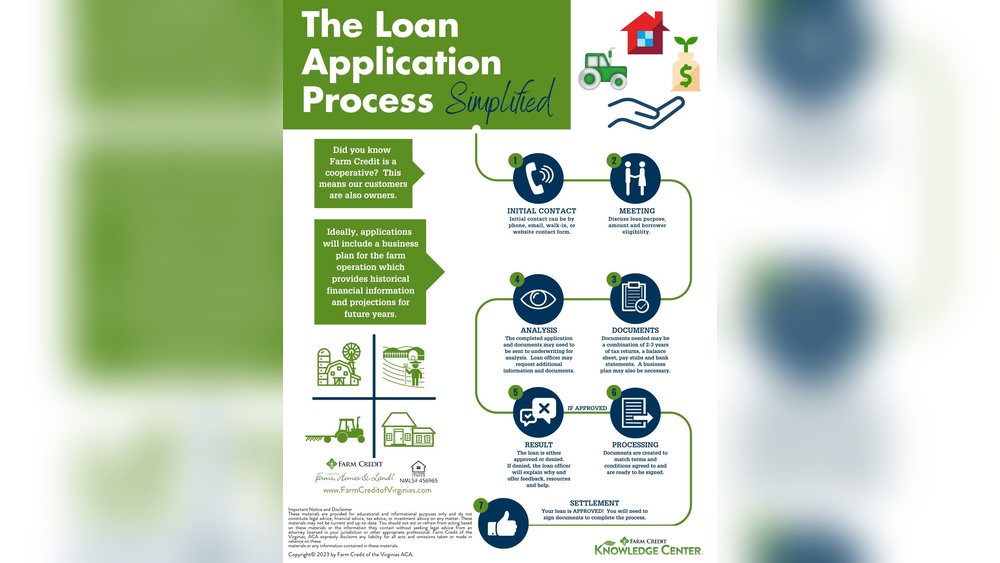

Credit: www.farmcreditofvirginias.com

Credit: creately.com

Frequently Asked Questions

What Documents Are Needed For A Loan Application?

You typically need ID proof, income statements, bank statements, and address proof. Additional documents depend on loan type and lender requirements. Always check specific lender guidelines before applying to avoid delays and ensure a smooth loan approval process.

How Long Does The Loan Application Process Take?

Loan approval times vary widely, usually from a few hours to several days. Factors include lender policies, document verification, and loan type. Online applications tend to be faster, while traditional banks may take longer due to manual checks.

Can I Apply For A Loan With Bad Credit?

Yes, some lenders offer loans to applicants with bad credit. These loans may have higher interest rates or stricter terms. Improving credit score before applying increases approval chances and may secure better loan conditions.

How Do Lenders Assess Loan Eligibility?

Lenders review your credit score, income stability, debt-to-income ratio, and employment history. They also consider loan amount and purpose. Meeting these criteria increases your chances of loan approval and favorable terms.

Conclusion

Applying for a loan is easier with clear steps. Gather your documents, fill out the form carefully, and submit it on time. Keep track of your application and follow up if needed. Understanding this process helps you avoid mistakes and saves time.

Stay patient and organized to improve your chances. This way, you can handle your loan application with confidence and success.