Are you thinking about taking out a personal loan but worried about the interest rates? Understanding personal loan interest rates can save you a lot of money and stress.

Your rate affects how much you’ll pay back every month and overall. But don’t worry—this article will break down everything you need to know in simple terms. By the end, you’ll feel confident making the best choice for your financial future.

Keep reading to discover how to find the lowest rates and avoid hidden costs that could catch you off guard.

What Determines Personal Loan Rates

Credit score plays a big role in personal loan rates. A higher score means lower interest rates. Lenders see good credit as less risky. Lower scores get higher rates to cover risk.

Loan amount and term length also affect rates. Bigger loans often have higher rates. Shorter terms usually have lower rates. Longer terms spread payments out but cost more in interest.

| Lender Type | Typical Rate Range | Notes |

|---|---|---|

| Banks | 6% – 12% | Usually offer lower rates, stricter approval |

| Credit Unions | 5% – 10% | Member-focused, often lower rates |

| Online Lenders | 7% – 20% | Faster approval, rates vary widely |

:max_bytes(150000):strip_icc()/fQk6k-average-personal-loan-interest-rate-june-2025-eb8b538bee1f432ab7f49cf5f981f27f.png)

Credit: www.investopedia.com

Types Of Personal Loan Rates

Fixed rates stay the same for the whole loan time. This means your monthly payment does not change. It helps with easy planning and no surprises.

Variable rates can change over time. The rate goes up or down depending on the market. Payments may be lower or higher during the loan period.

Fixed rates offer stability, while variable rates might save money if rates drop. But variable rates come with more risk if rates rise.

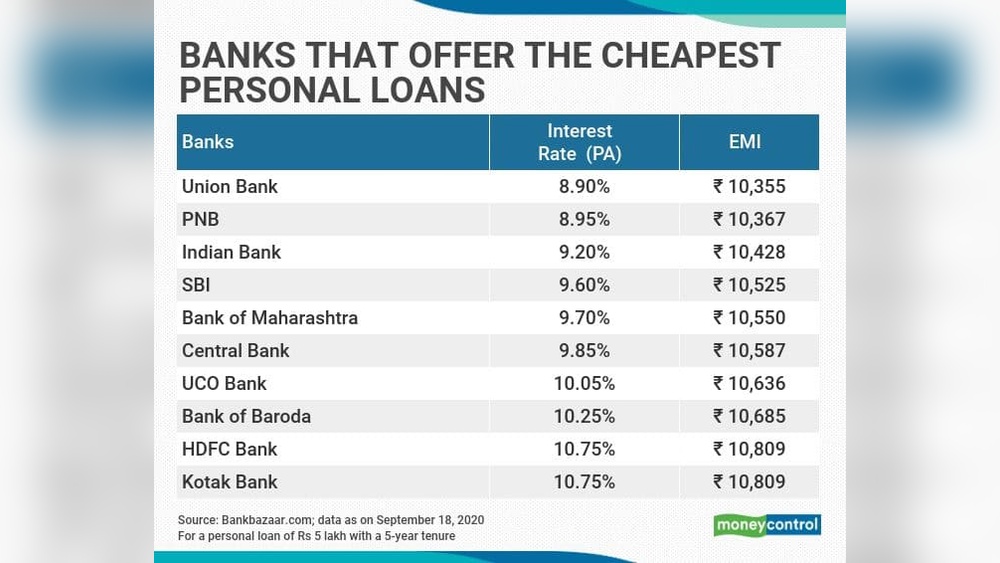

How To Find Low Personal Loan Rates

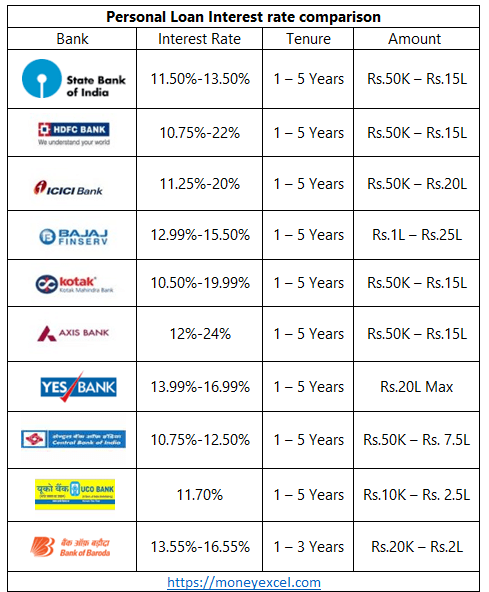

Compare interest rates from different lenders. Some banks offer lower rates than others. Check online and local banks. Look at loan terms and fees too.

Raise your credit score to get better loan rates. Pay bills on time and reduce debt. A higher score shows you are a trustworthy borrower. This helps lenders offer lower rates.

Try to negotiate loan terms with lenders. Ask for a lower interest rate or better repayment options. Sometimes, lenders agree to reduce costs to win your business.

Hidden Costs That Affect Loan Savings

Origination fees are charges lenders add when giving a loan. These fees lower your total savings because they increase the loan cost.

Prepayment penalties happen if you pay your loan early. Lenders may charge extra fees, reducing the benefit of paying off debt faster.

Late payment charges occur if you miss a due date. These fees add up quickly and increase how much you owe overall.

| Hidden Cost | What It Means | Impact on Savings |

|---|---|---|

| Origination Fees | Fee for processing the loan | Raises total loan cost |

| Prepayment Penalties | Fee for paying loan early | Reduces benefit of early payoff |

| Late Payment Charges | Fee for late payments | Increases total amount owed |

Using Low Interest Loans To Save Big

Low interest loans help save money by reducing monthly payments. Debt consolidation combines multiple debts into one loan with a lower rate. This makes paying off debt easier and faster. It also helps avoid late fees and lowers stress.

Loans with low interest rates are great for home improvement. They allow you to fix or upgrade your house without big upfront costs. You can spread payments over time, making it affordable and less stressful.

Emergency expenses can happen anytime. Low interest personal loans provide quick cash for sudden costs like medical bills or car repairs. This helps avoid expensive credit card interest or borrowing from friends.

Credit: www.peopledrivencu.org

Alternatives To Traditional Personal Loans

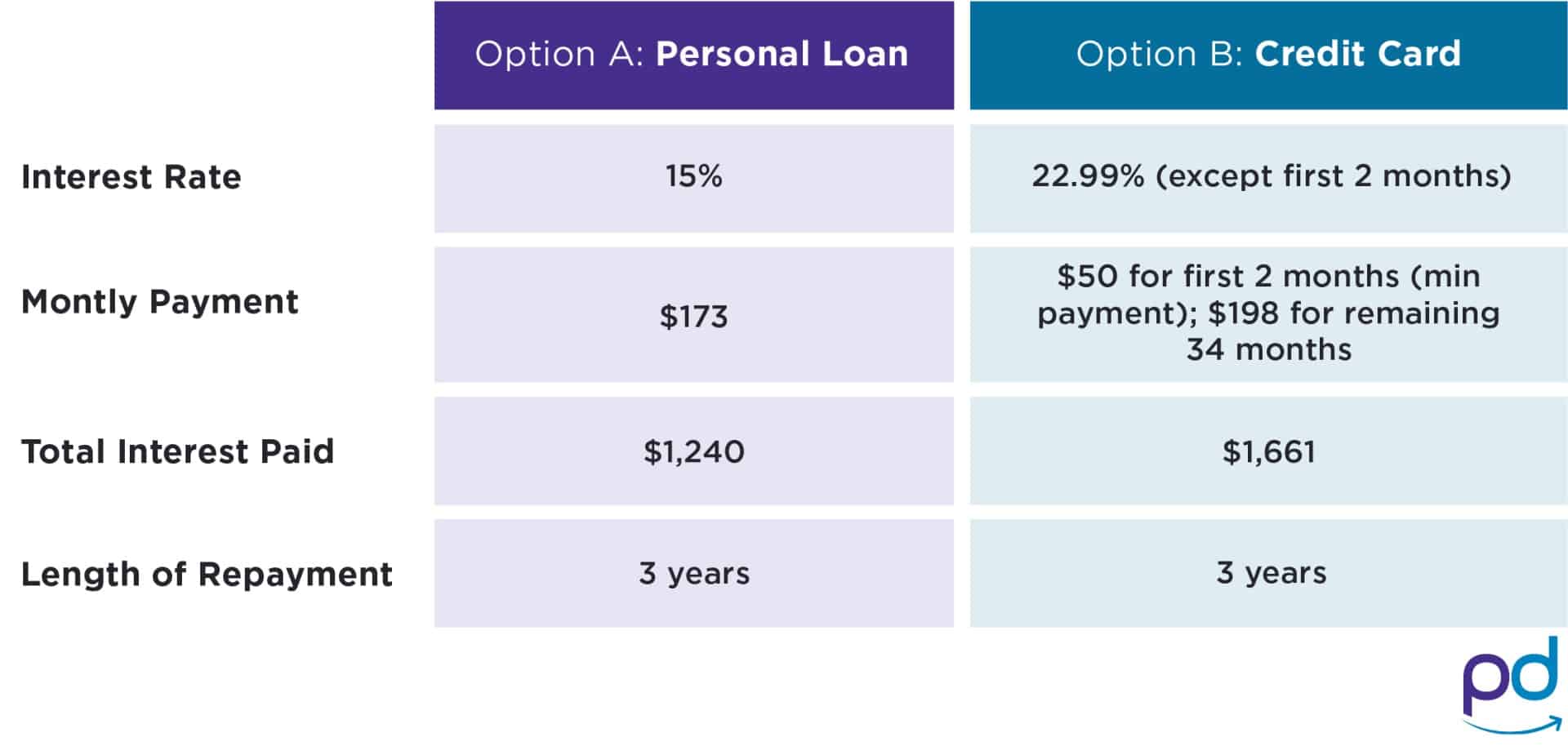

Credit cards offer a flexible way to borrow money but often have higher interest rates than personal loans. They are good for small purchases or emergencies but can lead to debt if not paid quickly. Personal loans have fixed payments and usually lower interest rates, making them easier to budget for.

Peer-to-peer lending connects borrowers with individual investors online. It can offer competitive rates and faster approval than banks. But, it might have stricter credit score requirements and less regulation.

Credit unions often provide lower interest rates than big banks. They are nonprofit and focus on helping members. Online lenders also offer personal loans with fast approval and simple application processes. Comparing rates and terms is important before choosing a lender.

Credit: edtimes.in

Frequently Asked Questions

What Factors Affect Personal Loan Interest Rates?

Personal loan interest rates depend on credit score, income, loan amount, and lender policies. Higher credit scores often get lower rates. Loan duration and market conditions also impact rates. Lenders assess risk to set your interest rate.

How Can I Get The Lowest Personal Loan Interest Rate?

To get the lowest rate, maintain a strong credit score and stable income. Shop around and compare lenders. Opt for shorter loan terms and avoid unnecessary fees. Pre-approval can help lock in better rates.

Are Personal Loan Interest Rates Fixed Or Variable?

Personal loan interest rates can be fixed or variable. Fixed rates stay the same throughout the loan term. Variable rates may change based on market conditions. Knowing your loan type helps predict payment amounts.

How Do Personal Loan Interest Rates Compare To Credit Cards?

Personal loan rates are generally lower than credit card rates. Loans offer fixed payments and terms, while cards have revolving balances. Using personal loans can reduce overall interest costs compared to credit cards.

Conclusion

Personal loan interest rates affect how much you repay. Lower rates save money over time. Check rates from different lenders before choosing. Your credit score can help get better rates. Understand terms and conditions clearly to avoid surprises. Compare fixed and variable rates carefully.

Make payments on time to keep good credit. Knowing these facts helps you borrow smartly. Keep control of your finances with wise choices.