Are you facing an unexpected expense or a sudden cash crunch? Finding the right short term loan option can make all the difference in managing your finances smoothly.

But with so many choices out there, how do you pick the best one for your needs? This guide will help you understand your options clearly, so you can make smart decisions that protect your wallet and give you peace of mind.

Keep reading to discover the loan solutions that fit your situation perfectly.

Credit: www.loanry.com

Types Of Short Term Loans

Payday loans offer small amounts of money. They must be paid back on your next payday. These loans have high interest rates. They are quick but can be expensive.

Personal installment loans give a fixed amount of money. You pay back in small monthly payments. These loans have lower interest than payday loans. They help with bigger expenses.

Credit card advances let you borrow money from your credit card. You pay interest right after taking the cash. They are easy but can have high fees.

Title loans use your car title as security. You get money but risk losing your car if you don’t pay. Interest rates are often very high.

When To Choose Short Term Loans

Short term loans help cover costs that can’t wait. Emergencies like car repairs or medical bills need quick money. These loans give fast cash without long waits.

Unexpected bills can cause stress. Short term loans fill the gap until payday arrives. This avoids late fees or service cuts.

Sometimes, income is not steady. Short term loans help bridge money gaps during tough times. They keep bills paid and life running smoothly.

Small businesses often face urgent needs. Short term loans provide funds for supplies or repairs. This support keeps the business open and customers happy.

Key Features To Consider

Loan amounts vary by lender and purpose. Small loans suit urgent needs, while larger ones cover bigger expenses. Choose a loan amount that fits your budget and need.

Repayment terms can be short or a bit longer. Short terms mean faster payback but higher monthly payments. Longer terms lower monthly costs but may increase total interest.

Interest rates affect how much you pay back. Lower rates save money. Compare rates carefully before choosing a loan. Fixed rates stay the same; variable rates can change over time.

Application speed matters for urgent cash. Some lenders approve loans in minutes, others take days. Quick approval helps in emergencies but check all loan details first.

Benefits Of Quick Loan Solutions

Quick loan solutions offer fast approval, so you get money quickly. Usually, they need minimal documentation, which saves time and effort. You can use the loan for many purposes, giving you flexible use. These loans often do not affect your credit score much. It helps keep your financial record safe. Fast approval means less waiting, which is helpful in emergencies. Minimal paperwork means less hassle and stress. Flexible use lets you decide how to spend the money. Little impact on credit score keeps your future borrowing options open.

Risks And Precautions

High interest costs make short term loans expensive. Borrowers pay back much more than they borrow. This can cause serious money problems fast.

Potential for debt cycle is common. People may take new loans to pay old ones. This traps them in endless borrowing and paying more fees.

Some loans have hidden fees. These fees appear after signing the contract. They increase the total cost and surprise borrowers.

Lender reputation matters a lot. Choose lenders known for honesty and clear terms. Bad lenders may trick borrowers or charge unfair fees.

Credit: thewhitelistedestates.in

Alternatives To Short Term Loans

Borrowing from friends or family can be a quick way to get money without high interest rates. This option often has flexible payback terms. It builds trust but may affect relationships if not handled well.

Credit union loans usually offer lower rates than banks. They are good for small, short-term needs. Joining a credit union may take time, but the benefits include friendly service and lower fees.

Employer advances let workers get money before payday. It is easy and fast but often limited to a portion of your salary. This option avoids interest but may reduce your next paycheck.

Selling unused items can raise cash quickly. Clothes, electronics, or furniture you no longer need can bring money fast. This method avoids debt and clears clutter at the same time.

Tips For Responsible Borrowing

Check your income and expenses before borrowing money. Make sure you can pay back the loan on time. Missing payments can cause extra fees and hurt your credit score.

Look at different loan offers. Compare interest rates, fees, and terms. Choose the loan that fits your needs and budget best.

Read the loan terms carefully. Know the payment schedule, fees, and penalties. Ask questions if something is not clear.

Have a plan for emergencies. Save some money to cover unexpected costs. This helps you avoid taking another loan quickly.

Credit: www.planprojections.com

Frequently Asked Questions

What Are The Common Types Of Short Term Loans?

Short term loans include payday loans, personal installment loans, and lines of credit. They typically last from a few weeks to a year. These options offer quick access to funds for urgent financial needs.

How Do Interest Rates Vary For Short Term Loans?

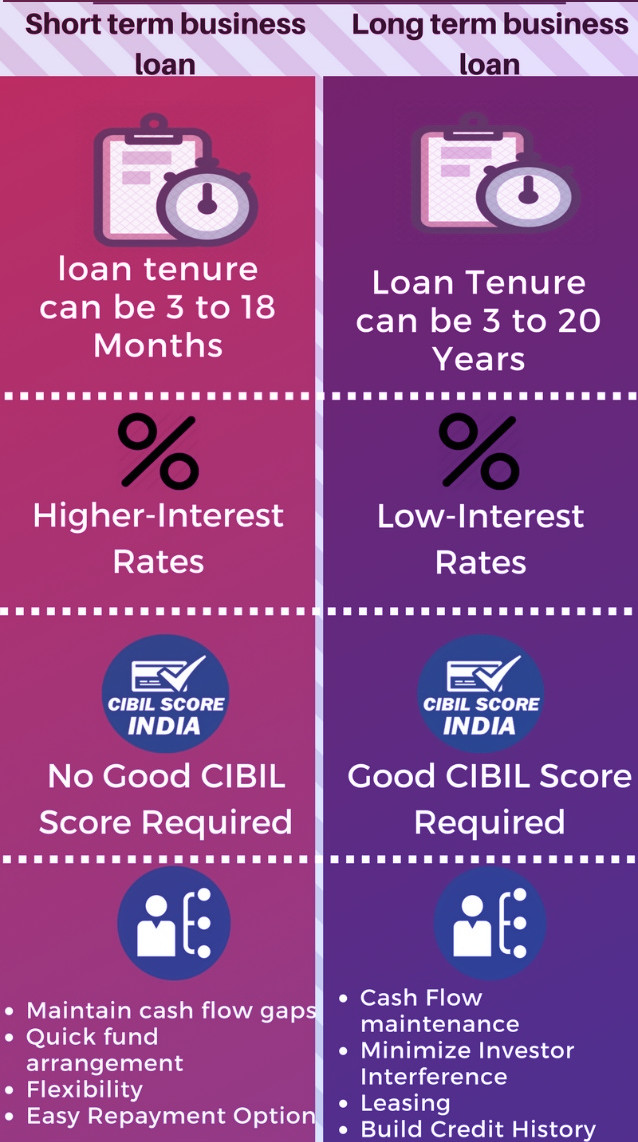

Interest rates on short term loans are usually higher than long-term loans. Rates depend on the lender, loan type, and borrower’s credit score. It’s crucial to compare rates before choosing a loan.

Can I Get A Short Term Loan With Bad Credit?

Yes, some lenders offer short term loans to borrowers with bad credit. However, interest rates may be higher and loan terms stricter. It’s important to review all terms carefully before applying.

What Are The Risks Of Short Term Loans?

Short term loans can have high interest and fees. Missing payments may damage your credit score. Borrowers should ensure they can repay on time to avoid financial strain.

Conclusion

Short term loans can help in urgent money needs. Choose the option that fits your budget. Read all terms carefully before you borrow. Keep track of repayment dates to avoid extra fees. Use loans wisely to stay financially safe. Understanding your choices leads to better decisions.

Plan ahead to prevent future money problems. Simple steps make borrowing easier and less risky.