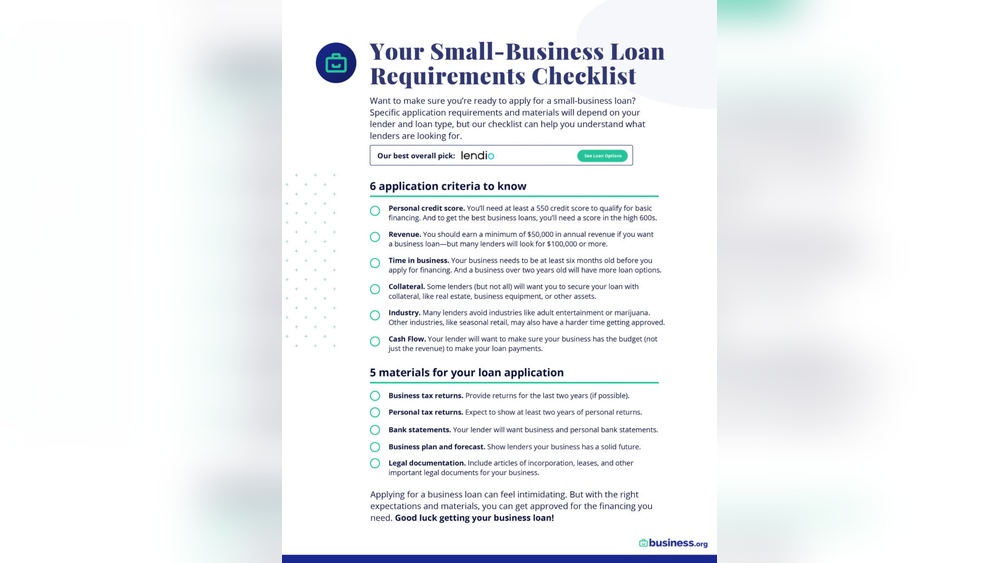

Are you thinking about getting a loan to grow your small business? Knowing the right requirements can make the process much easier and faster for you.

Imagine having a clear checklist that guides you step-by-step, so you avoid surprises and boost your chances of approval. You’ll discover exactly what lenders want to see from you. By the end, you’ll feel confident and ready to take the next step toward securing the funds your business needs.

Keep reading to unlock the secrets behind small business loan requirements.

Types Of Small Business Loans

Term loans provide a fixed amount of money paid back over time. They suit businesses needing a lump sum for growth or expenses. Payments happen monthly with interest.

SBA loans are backed by the government. They offer lower interest rates and longer terms. Small businesses gain easier access to funds with SBA support.

Lines of credit let businesses borrow up to a limit. Borrow only what is needed and repay flexibly. This helps manage cash flow and short-term needs.

Equipment financing helps buy machines or tools. The equipment itself acts as collateral. Payments spread out, matching the equipment’s useful life.

Credit: cumberlandbusiness.com

Basic Eligibility Criteria

Most lenders need a business to be at least 6 months old. Some ask for 1 or 2 years. The size of the business matters too. Small loans may have easier rules.

A good credit score helps get approval. Scores above 600 are usually needed. Higher scores get better rates. Poor credit might still get a loan but with higher interest.

| Requirement | Details |

|---|---|

| Revenue | Many lenders want at least $50,000 yearly income. |

| Cash Flow | Steady monthly cash flow shows ability to repay. |

Key Documents Needed

Financial statements show how much money your business makes and spends. Banks want to see profit and loss reports, balance sheets, and cash flow statements for the past 1-3 years. These prove your business is stable and can repay the loan.

Tax returns are important to show your official income to lenders. They usually ask for business and personal tax returns from the last 2-3 years. This helps verify your earnings and tax payments.

A clear business plan explains your business goals, products, and how you will make money. It also includes financial projections. Lenders want to understand your plan to check if you can repay the loan.

Legal documents prove your business is real and allowed to operate. Common papers include business licenses, permits, articles of incorporation, and ownership agreements. These documents build trust with lenders.

Credit: www.nbcbanking.com

Improving Your Credit Profile

Personal credit shows how well you pay your own bills. Business credit shows how your business handles money. Lenders check both before giving a loan.

Good personal credit helps get better loan offers. But strong business credit can help your company grow.

- Pay bills on time every month.

- Keep credit card balances low.

- Fix any errors on credit reports fast.

- Use credit regularly but wisely.

- Avoid applying for many loans at once.

- Build business credit by paying suppliers on time.

Preparing A Strong Loan Application

A clear business plan helps lenders understand your goals. It should include your business idea, market research, and financial projections. Keep it simple and easy to follow. A well-organized plan shows you are serious and prepared.

Showing repayment ability is key. Provide proof of income and cash flow statements. Lenders want to see you can pay back the loan on time. Include any past credit history and existing debts. Clear numbers build trust and confidence.

Common Reasons For Loan Denial

Loans often get denied due to incomplete documentation. Missing papers like tax returns, bank statements, or business plans cause delays or rejections. Lenders need full info to decide.

Poor financial health is another big reason. Low credit scores, unstable income, or past debts make lenders worry. They want to see steady money flow and good credit history.

Lack of collateral can also stop loan approval. Collateral gives lenders a safety net if payments stop. Without valuable assets, lenders feel more risk and may say no.

Alternative Financing Options

Crowdfunding lets many people give small amounts of money. This helps raise funds without loans. Platforms like Kickstarter or Indiegogo are popular choices. It works well for creative projects and new products. Success depends on sharing your idea clearly.

Angel Investors are individuals who invest money in small businesses. They offer funds in exchange for part ownership. They often give advice too. Finding the right angel investor means sharing your business plan well.

Microloans are small loans given by nonprofit groups or community lenders. They help businesses that need less money than banks require. Microloans usually have easier rules and lower interest rates. Good for startups or those with less credit history.

Credit: cdcloans.com

Frequently Asked Questions

What Credit Score Is Needed For A Small Business Loan?

Most lenders require a minimum credit score of 600 to 650. Higher scores improve approval chances and loan terms. Good credit shows lenders you are financially responsible and lowers their risk.

What Documents Are Required For A Small Business Loan?

Common documents include business financial statements, tax returns, bank statements, and legal business licenses. Lenders may also ask for a business plan and personal financial information to assess your loan eligibility.

How Much Collateral Is Needed For A Small Business Loan?

Collateral requirements vary by lender and loan type. Typically, lenders ask for assets like equipment, real estate, or inventory. Collateral reduces lender risk and can improve loan approval and interest rates.

How Long Does It Take To Get A Small Business Loan?

Loan approval times vary from a few days to several weeks. Online lenders often offer faster approvals, while traditional banks may take longer due to stricter checks and paperwork.

Conclusion

Getting a small business loan needs clear steps and good preparation. Know your credit score and gather important documents first. Lenders want to see a solid plan and proof you can repay. Keep your financial records organized and be honest about your needs.

Meeting these requirements helps you get the loan faster. Careful planning makes the process easier and less stressful. Stay focused and patient to reach your business goals.